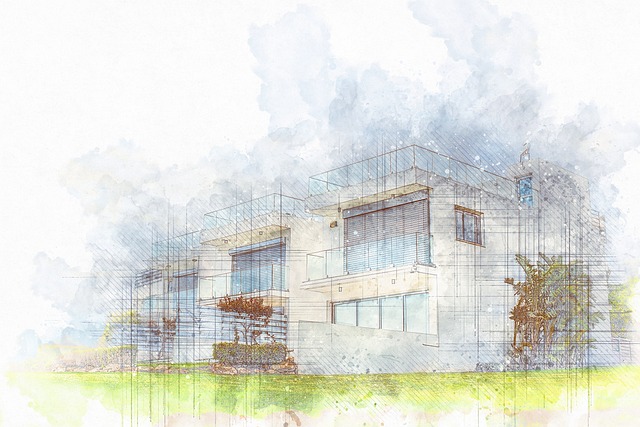

Guiding Multifamily Loan Success in Denver: Support Strategies for Optimal Results

In Denver's competitive real estate market, success with multifamily loans requires strategic s…….

In Denver's competitive real estate market, success with multifamily loans requires strategic support. This includes early engagement, regular communication via dedicated channels, proactive problem-solving, and partnerships with reputable service providers. Effective communication fosters transparency among lenders, investors, developers, and tenants, facilitating swift issue resolution and informed decision-making. Meticulous financial planning, including contingency funds and ongoing budget reviews, ensures cost management and adaptability to market changes, ultimately driving project success in Denver's dynamic multifamily loan landscape.

In the dynamic landscape of Denver’s real estate market, successful multifamily loan projects hinge on ongoing support. This article delves into the paramount importance of continuous project assistance, offering a strategic roadmap for investors and developers. We explore key tactics for effective project support, emphasize the critical roles of communication and transparency, and address common challenges encountered during execution. By harnessing these insights, stakeholders can navigate Denver’s market with enhanced confidence, ensuring project milestones are met and returns optimized. “Multifamily loan Denver” success stories await those who prioritize proactive, comprehensive project management.

- Understanding the Importance of Ongoing Support in Multifamily Loan Projects

- Key Strategies for Effective Project Support in Denver's Real Estate Market

- The Role of Communication and Transparency in Ensuring Success

- Common Challenges and How to Overcome Them During Project Execution

Understanding the Importance of Ongoing Support in Multifamily Loan Projects

In the dynamic landscape of multifamily development, ongoing support is a cornerstone that distinguishes successful projects from mere successes. For instance, in Denver’s vibrant real estate market, where multifamily loans are a significant component of growth, continuous assistance throughout the project lifecycle is vital. This includes pre-construction planning, financial management during construction, and post-completion support to ensure the property’s long-term viability.

Without adequate ongoing support, projects can encounter unforeseen challenges, leading to delays, budget overruns, or even failure to meet market expectations. A comprehensive support system, tailored to Denver’s multifamily loan sector, involves regular communication, proactive problem-solving, and access to specialized resources. This ensures that developers, lenders, and investors are aligned, fostering a collaborative environment that drives project excellence and maximizes returns in this competitive market.

Key Strategies for Effective Project Support in Denver's Real Estate Market

In the dynamic Denver real estate market, providing ongoing support for projects is paramount to success. For multifamily loan applications in Denver, a strategic approach ensures smooth sailing from initial inquiry to closing. Engaging directly with borrowers, lenders, and investors early on fosters transparency and builds trust, setting a solid foundation for the project’s financial health. Regular communication channels, such as dedicated email threads or collaborative platforms, keep all stakeholders informed about milestones, potential hurdles, and market trends specific to Denver’s evolving landscape.

Key strategies include customizing support based on individual project needs. Whether it’s navigating complex regulatory environments or leveraging local market insights for property valuation, a deep understanding of Denver’s multifamily loan landscape is crucial. Offering proactive problem-solving and adaptive planning demonstrates expertise and commitment. Additionally, fostering partnerships with reputable service providers—from appraisers to legal experts—ensures that every aspect of the project receives professional attention, enhancing the overall success rate in this competitive market.

The Role of Communication and Transparency in Ensuring Success

Effective communication and transparency are pivotal for the success of any project, especially in the complex landscape of multifamily loan investments in Denver. Open and regular dialogue between all stakeholders—lenders, investors, developers, and tenants—is essential to navigate challenges and seize opportunities that arise during the lifecycle of a project. Transparency fosters trust, ensuring everyone is aligned with project goals and informed about key decisions and changes.

In the context of a multifamily loan in Denver, clear communication channels allow for swift issue resolution, informed decision-making, and adjustments to strategies as market conditions evolve. Regular updates on financial performance, tenant occupancy rates, and maintenance issues keep all parties apprised, enabling proactive management and preventing surprises that could jeopardize the project’s success. This is particularly crucial given the dynamic nature of Denver’s real estate market, where timely responses and adaptive strategies can make a significant difference in project outcomes.

Common Challenges and How to Overcome Them During Project Execution

During project execution, especially in complex endeavors like a multifamily loan in Denver, numerous challenges can arise that may threaten timelines and budgets. One common hurdle is communication breakdowns, which can result from misaligned expectations among stakeholders—from borrowers to lenders and construction teams. Effective mitigation involves establishing clear lines of communication, setting regular check-ins, and ensuring all parties understand their roles and responsibilities. Regular progress updates and transparent discussions help in promptly addressing any concerns or discrepancies.

Another significant challenge is unexpected costs, which can stem from factors like market fluctuations, unforeseen construction issues, or changes in regulations. To overcome this, meticulous financial planning is crucial. Comprehensive budgeting, including contingency funds, should be part of the initial project strategy. Regular reviews and adjustments to the budget throughout the project’s lifespan ensure that any deviations are quickly identified and managed. Additionally, staying informed about industry trends and regulatory updates can help anticipate potential cost drivers.

In the dynamic Denver real estate market, successful multifamily loan projects hinge on robust ongoing support. By implementing key strategies that emphasize communication, transparency, and proactive challenge mitigation, lenders can ensure these projects thrive. Understanding the unique demands of each stage, from planning to execution, is crucial for fostering strong partnerships with borrowers and achieving favorable outcomes for all stakeholders in the multifaceted world of Denver multifamily loans.